What is Ch11?

Chapter 11 is a reorganization type of bankruptcy where, if successful, your debts are reduced and reorganized so that you can make lower payments, on a more comfortable schedule, towards a reduced debt load, while continuing to operate your business.

Who can file Ch11?

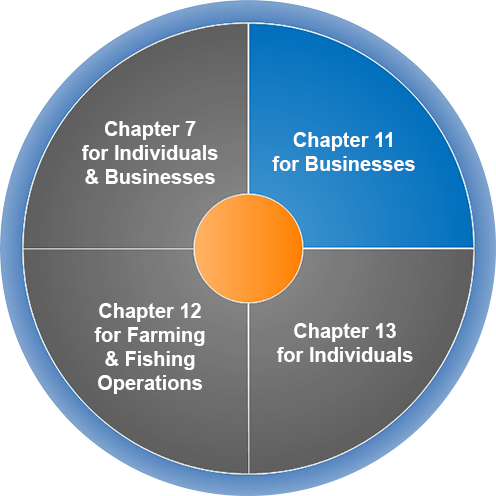

- Chapter 11 is a debt reorganization bankruptcy mostly filed by businesses.

- Although individuals are eligible to file for Chapter 11, usually individuals are better off filing Chapter 7 or Chapter 13.

- Government agencies and estates are not eligible to file Chapter 11 bankruptcy

How long does it take?

- A Chapter 11 case could be in the courts for years. It is a complex process with many individual and government agencies involved. Often the documentation is in hundreds or even thousands of pages which takes many months to evaluate.

- There are many tests and hearings before a decision is reached which can take many years.

- The process of Chapter 11 is broken up into two phases—pre- and post-confirmation.

- The pre-confirmation phase can last up to two years.

- The post-confirmation phase can last up to three to five years.

What are the steps involved in Ch11?

In a Chapter 11 bankruptcy filing, a petition and required documents need to filed. Some of the documents are:

- File the Chapter 11 petition in federal bankruptcy court (In Massachusetts they are located in Boston, Springfield, and Worcester)

- File other required documents within 15 days of filing the petition

- During the first month you are required to hold an initial meeting with your creditors

- During the first four months you are allowed to file your own reorganization plan for a judge to consider

- If you don’t file a plan during the first four months, then your creditors can submit their plans to the judge for consideration

- Satisfy the means-test. A means test is where your income and liabilities are analyzed to arrive at a payment plan. If no viable calculation can be accomplished then Chapter 11 may not be available to you.

- Comply with the judge’s instructions

What documents will I need?

In order to file for Chapter 11, you need to file a petition for bankruptcy in the federal bankruptcy court. In addition, you need to file the following documents:

- Statement of assets and liabilities

- Income and expense statement

- List of contracts and agreements

- Matrix of creditors- a list of all the creditors with their contact information

- Copy of the most recent tax return- IRS is usually an automatic creditor in most Chapter 11 cases

- For individuals, proof of credit counseling and a payment plan if one was developed

- There may be other documents based on your situation

Will I become debt free at the end of Ch11?

- At the end of Chapter 11 process, part of your debts will be reduced but you will not become completely debt free unless a judge specifically discharges debts. You are free not to pay only the discharged debts.

- Certain debts will be reduced and business operations will be reorganized and consolidated to reduce expenses.

- This reorganization plan will make it possible for you to make payments to creditors with an amount that is affordable and a schedule that is manageable.

- You still have to pay your secured creditors by liquidating assets. If there are too many debts secured by assets then this Chapter 11 filing may be converted to a Chapter 7 case so that the assets can be liquidated and secured creditors paid off.

- Bondholders (those who have loaned money to your company) and shareholders (those who own equity in your company) are immediately behind the secured creditors in the line. In some cases the bonds or shares may be canceled but this process can be very complicated with significant tax implications.

- In addition, sometimes, as part of reorganization your workforce is reduced so you no longer have to continue employees on the payroll.

How will Ch11 filing affect my credit?

- Just like any bankruptcy filing, Chapter 11 filing and disposition could reduce your credit score and make it more difficult and expensive to obtain new credit.

- Chapter 11 stays on your file for 10 years.

- It could reduce your credit score by 200-400 points.

- With any other type of rebuilding, you can rebuild your credit by staying committed to the reorganization plan and paying your bills on time.

Ch11 FAQs

Coming soon...