What is Ch13?

Chapter 13 bankruptcies are designed for individual consumers who either wish to or need to repay some or all of their debts. If you are trying to save your home but are behind on your mortgage, or make too much money to file a Chapter 7 you should consider a Chapter 13. In a Chapter 13, you can usually:

- Stop foreclosure proceedings or car repossessions.

- Repay the arrearage on your mortgage or your car loan over a five-year period.

- Eliminate your second mortgage if your house is worth less than what you owe on the first mortgage.

- Pay unpaid taxes over a five-year period.

Chapter 13 bankruptcy is a plan for wage earners who wish to repay their debts in an organized way. It includes a provision for cramdown repayment. Cramdown repayment is where the debtor’s secured debt is stripped down to the value of the property. For example, if a debtor owes a bank $10,000 on a car, and the value of the car is $8,000, the debt is reduced to $8,000.

An individual may file for Chapter 13 bankruptcy as long as the individual is willing to submit a payment plan that is acceptable to the judge. Eligibility criteria include the following:

- You must be an individual or file jointly with a spouse

- You must have income from a job

- You must not have unsecured debt in excess of $307,000

- You must not have secured debt in excess of $922,000

- Corporations, partnerships, commercial enterprises, stock brokers or commodity brokers are not eligible for Chapter 13 bankruptcy

How long does it take?

A Chapter 13 bankruptcy proceeding can take three to five years.

What are the steps involved in Ch13

What documents will I need?

In order to file a Chapter 13 bankruptcy, you need to file:

- A petition

- A repayment plan. This plan may or may not be acceptable to the creditors but as long as the judge approves it, it becomes valid. If a plan includes starting the payments within 30 days of filing and completing all the payments within three to five years, most judges accept the plan

- Statement of assets and liabilities

- Income and expense statement, including sources of income

- List of contracts, such as lease or rental agreement

- Copy of the most recent tax return

Will I become debt free at the end of Ch13?

A judge may approve a reduce payment plan. Once the payments are all completed according to the plan, the reduction portion is discharged. If you fail to make payments according to the plan, or fail to obtain modification, then the reduction will not be discharged.

How will Ch13 filing affect my credit?

Chapter 13 affects your credit rating in much the same way as it does by filing a Chapter 7 bankruptcy.

Ch13 FAQs

How does Chapter 13 save my house from foreclosure?

The filing of a Chapter 13 petition at any time before a foreclosure sale stops the sale. Individuals in Chapter 13 then file a Plan with the Court that provides for the repayment of your mortgage arrears over a 3-5 year period. For example, if you are behind $30,000 on your mortgage, you can generally file a plan that calls for repayment of that amount at the rate of $500/month for 60 months. You would also have to resume making current mortgage payments.

I have heard that you can eliminate second and third mortgages in Chapter 13. Is that true?

Sometimes. If the value of your house is less than the amount you owe on the first mortgage (including any arrears), then your attorney can file a motion with the court asking that the junior mortgage (or other liens, like real estate attachments) be eliminated.

How are unpaid taxes handled in a Chapter 13?

Taxes that cannot be discharged in bankruptcy, such as unpaid meals taxes, sales taxes or payroll taxes or recent income taxes can be part of a debtor’s 3-5 year plan.

Is filing bankruptcy right for me?

Bankruptcy is not the answer for everyone. Ask your bankruptcy lawyer to explain why bankruptcy is the best choice in your circumstance.

Which type of bankruptcy should I file?

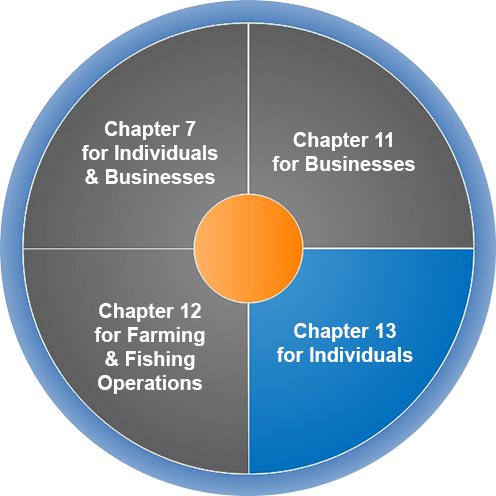

There are two important kinds of bankruptcies: Chapter 7 and Chapter 13.

In Chapter 7, you might have to give up some of your property that isn’t protected by the law in exchange for getting rid of your debt.

In Chapter 13, you don’t lose any property, but you must follow a three-to-five-year plan to repay your debts. A good lawyer should be able to explain these types of bankruptcy in simple terms and tell you which one is best for your situation and why.

What alternatives to bankruptcy should I consider?

If bankruptcy isn’t right for you, ask what other options you should consider. Some alternatives may include debt consolidation, negotiating with creditors or establishing a repayment or debt management plan.

How much does filing for bankruptcy cost?

Your lawyer should clearly and carefully explain how they charge for their services and give you a written agreement that spells out all the costs involved. Make sure you grasp not just the lawyer’s fees but also any filing fees and additional expenses you’ll need to cover.

Take the time to talk about how and when you’ll make payments. Don’t hesitate to ask for clarification if anything about the fees or billing is unclear to you. Your lawyer has a duty to make sure you fully understand these financial aspects.

What is the bankruptcy process?

Your bankruptcy lawyer should be able to explain each step in simple terms and let you know when they plan to file your case. This way, you’ll have a clear starting point for the bankruptcy timeline.

What will a bankruptcy lawyer require from me?

You will also have some work to do during the bankruptcy process.

Your lawyer will need certain documents from you, such as tax returns, pay stubs, real estate documents, and more.

The materials you’ll have to produce will vary depending on the specifics of your case. You should also expect to fill out any required paperwork and turn it over to your lawyer to review.

Do bankruptcy lawyers help rebuild credit scores afterwards?

After going through bankruptcy, your credit score may suffer, but it’s possible to rebuild it. Some bankruptcy attorneys can help by checking your credit reports for accuracy and suggesting steps to improve it.